Individual Retirement Account

Secure Your Future with an Individual Retirement Account

We’ve got the IRA that’s right for you!

Whether you are looking for a Traditional IRA, a Roth IRA, an Education IRA, or you are wanting to roll over funds from your current Employer’s Retirement plan, we’ve got just the IRA you are looking for.

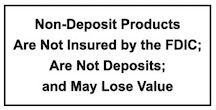

All Citizens Bank IRAs earn current interest rates, and you have the peace of mind of knowing your “retirement nest egg” is safe and secure. All Citizens Bank IRAs are insured by the FDIC up to $250,000.00.

Starting a Citizens Bank retirement account is easy. All of our IRAs can be opened with as little as $100.00, and you can add to your account at any time! We have highly trained staff to answer your IRA questions, and we never charge a fee!

You have until April 15th to make a contribution for the previous tax year so call us today at Eldon Main 573-392-3381 or Versailles at 573-378-5464 to get started!

| Individual Retirement Account | Description |

|---|---|

| Traditional IRA | Deposit up to $7,000.00 per year to a Traditional IRA and you may be able to save on your present taxes by deducting your qualified contributions from your taxable income. If you are 50 or older you may deposit up to an additional $1,000.00 per year. Many Americans can deduct all or part of their IRA contributions from current income taxes. A Traditional IRA allows you to defer taxes until you retire when you will probably be in a lower tax bracket. |

| Roth IRA | A Citizens Bank Roth IRA is a great way to save and enjoy the benefits of having your earnings grow tax free! As long as you have earned income, you can deposit up to $7.000.00 per year into a Roth IRA and never pay taxes on the interest. You can deposit an additional $1,000.00 per year if you are 50 or older. While contributions are not tax deductible, contributions and earnings can be withdrawn tax free, and unlike traditional IRAs, you are not required to begin taking required minimum distributions after reaching age 73. By converting your traditional IRA to a Roth IRA, you can enjoy tax-free withdrawals. However, the amount you convert is subject to income tax now. |

| Education IRA | A Coverdell Education Savings Account is a great way for parents, grandparents, and others to help meet the rising cost of a student's education. With a Citizens Bank Education IRA, you can deposit up to $2,000.00 per year, per child. While there is no tax deduction for amounts contributed, earnings grow tax free. Your Citizens Bank Education Savings Account can be used to pay qualified elementary school and secondary school expenses as well as college expenses. |

| Rollover IRA | If you are retiring or changing jobs and anticipate withdrawing money from your employer's retirement plan, you can avoid withdrawal penalties by transferring your assets into a Citizens Bank IRA. We can help you arrange for a "direct rollover" of your money into your IRA account with us and not pay the mandatory 20% withholding. For more information about IRA Rollovers or opening a new IRA just give us a call at 573-392-3381 or 573-378-5464. |